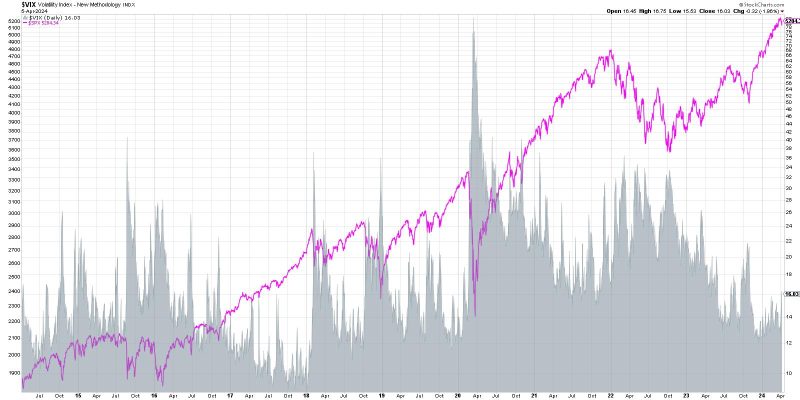

**The Impact of VIX Spiking Above 16**

The recent surge in the VIX index above 16 has raised concerns among investors and traders, sparking discussions about the potential implications for the financial markets. The VIX, also known as the fear index, is a measure of market volatility derived from S&P 500 options. When the VIX spikes, it is often interpreted as a sign of increased uncertainty and risk in the market.

The VIX crossing the 16 threshold has historically been seen as a significant level. It indicates a certain level of fear and uncertainty creeping into the market, as investors become more cautious about the outlook for stocks. The spike in the VIX above 16 suggests that traders are pricing in higher volatility in the near term, which could be driven by a variety of factors, such as geopolitical tensions, economic data releases, or market speculation.

One of the primary concerns when the VIX spikes above 16 is the potential impact on investor sentiment. High levels of market volatility can lead to increased anxiety among investors, causing them to make hasty decisions based on fear rather than rational analysis. This can result in erratic price movements and exacerbate market downturns.

Moreover, a spike in the VIX above 16 can also signal a shift in market dynamics, with the potential for increased trading volumes and heightened market fluctuations. Investors may adjust their strategies in response to the elevated volatility, leading to more frequent buying and selling activity. This increased trading volume can further amplify market volatility and contribute to a more turbulent trading environment.

In addition to affecting investor sentiment and trading behavior, a VIX spike above 16 can also have implications for risk management strategies. Investors may need to reassess their portfolio allocations and risk exposures in light of the heightened volatility. Those who rely on hedging strategies or volatility products may need to adjust their positions to protect against potential losses in a more volatile market environment.

Furthermore, the VIX spike above 16 could prompt market participants to closely monitor other key indicators and economic data points for signals about the market’s direction. Traders may pay closer attention to factors such as corporate earnings reports, interest rate decisions, and global economic trends to gauge the potential impact on market volatility and sentiment.

Ultimately, while a spike in the VIX above 16 may be a cause for concern among investors, it is important to approach market volatility with a level head and a long-term perspective. Volatility is a natural feature of financial markets, and periods of heightened uncertainty can also present opportunities for those who are prepared and nimble in their investment approach.

As market participants navigate the implications of the VIX spiking above 16, it is essential to remain informed, adaptable, and focused on long-term investment goals. By staying attuned to market developments and maintaining a disciplined investment strategy, investors can navigate volatile market conditions with resilience and confidence.