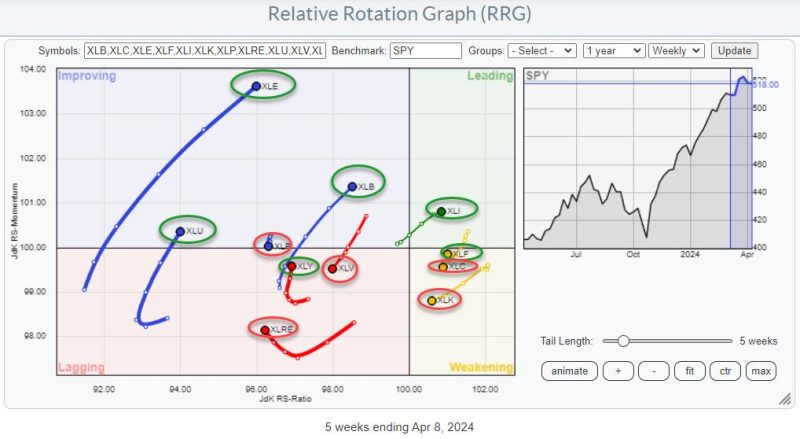

Rising indicators of non-mega-cap technology stocks have caught the attention of investors recently. According to the Relative Rotation Graph (RRG) analysis, these stocks are showing signs of improvement and potential growth in the market.

RRG analysis provides a visual representation of the relative strength and momentum of various sectors or stocks in the market. It maps out the movement of stocks based on their relative performance compared to a benchmark index. In the case of non-mega-cap technology stocks, the RRG indicates that they are moving towards the leading quadrant, suggesting a positive outlook for these stocks.

The technology sector has been a key driver of the stock market in recent years, with mega-cap tech companies like Apple, Amazon, and Microsoft leading the way. However, the performance of non-mega-cap technology stocks has often been overshadowed by these giants. The recent shift towards the leading quadrant on the RRG indicates a shift in momentum for these smaller tech companies.

Investors looking to diversify their portfolio or capitalize on the potential growth of non-mega-cap technology stocks may find the RRG analysis insightful. By identifying stocks that are gaining strength and momentum in the market, investors can pinpoint opportunities for investment and potentially outperform the broader market.

It is important to note, however, that RRG analysis is just one tool in the investor’s toolkit. Investors should conduct thorough research and analysis before making any investment decisions. Market conditions can change rapidly, and it is essential to stay informed and adaptable to navigate the ever-evolving landscape of the stock market.

In conclusion, the RRG analysis pointing towards the improvement of non-mega-cap technology stocks signals a potential shift in momentum in the market. Investors who are looking to capitalize on this trend should consider conducting further research and due diligence to identify investment opportunities that align with their financial goals and risk tolerance. Stay informed, stay proactive, and stay ahead in the dynamic world of stock market investing.