Relative rotation graphs (RRGs) have become a valuable tool for traders seeking to gain insights into market trends and identify potential trading opportunities. By visualizing the relative strength and momentum of different securities or asset classes, RRGs offer a unique perspective on market dynamics that can help inform trading strategies. In the world of finance, where timing is often crucial, the ability to quickly assess the shifting relationships between various assets can be a significant advantage.

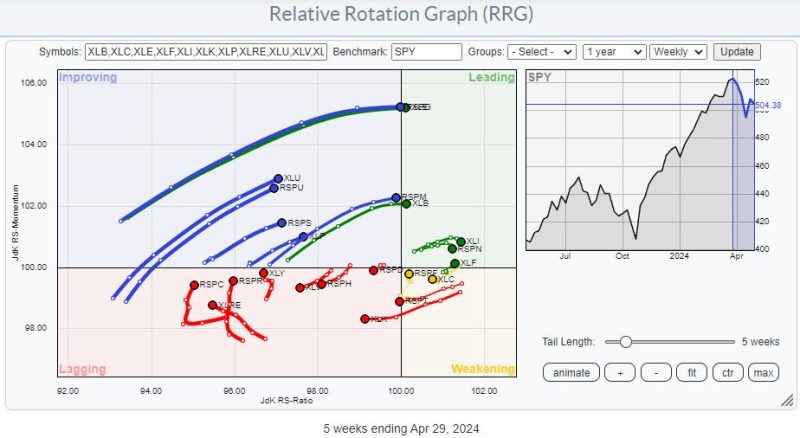

One key feature of RRGs is the ability to track the rotational movement of individual securities or asset classes in a dynamic two-dimensional space. This movement is typically represented by a curved path that indicates both the direction and magnitude of the rotation. By analyzing these paths, traders can identify assets that are moving towards the leading quadrant, which is associated with strong relative performance and momentum.

In the article Diverging Tails on this Relative Rotation Graph Unveil Trading Opportunities on GodzillaNewz.com, the author provides a detailed analysis of a specific RRG to highlight trading opportunities that emerge from the divergence of two asset classes. The article focuses on the tails of the rotation graph, which represent the trailing performance of the assets in question. By comparing the behavior of these tails, the author identifies potential trends that traders can capitalize on.

The article emphasizes the importance of understanding the underlying dynamics driving the rotational movement of assets on the RRG. In this case, the author notes a clear divergence between two asset classes, with one tail moving sharply lower while the other is on an upward trajectory. This divergence suggests a potential shift in market trends that traders can exploit by adjusting their positions accordingly.

Furthermore, the article highlights the significance of monitoring the relative strength and momentum of assets over time to capture evolving trading opportunities. By staying attuned to the changing dynamics depicted on the RRG, traders can adapt their strategies to align with emerging trends and potentially enhance their returns.

Overall, the article serves as a valuable educational resource for traders looking to leverage RRGs in their decision-making process. By providing a detailed analysis of a specific rotation graph and highlighting the trading opportunities it reveals, the article offers actionable insights that traders can use to inform their investment strategies. As the financial markets continue to evolve, tools like RRGs can provide traders with a competitive edge by enabling them to identify and capitalize on shifting market dynamics.