Certainly! Here is the well-structured and unique article:

The Godzilla of Market Trends: Is the Top Near?

In the vast ocean of financial markets, traders and investors are always on the lookout for the next big wave to ride. Riding the wave of a bullish market can be exhilarating, but just as the tide must turn, so too must the markets. As we navigate the choppy waters of economic uncertainty and market volatility in 2022, many are starting to question if the market is reaching its peak, or if we are still merely in the midst of a temporary swell.

Are we perhaps facing the looming shadow of a Godzilla-sized market correction, or is there still room for growth and expansion in the horizon? Let’s delve deeper into the current market conditions to decipher the signals and potential paths ahead.

The Market Landscape:

The current market landscape resembles a canvas painted with a mix of bold colors and subtle undertones. In recent months, we have witnessed record highs in key indices, such as the S&P 500 and the Nasdaq, fueled by robust corporate earnings, accommodative monetary policies, and the promise of post-pandemic economic recovery. However, beneath the surface, cracks and vulnerabilities have started to emerge, challenging the notion of an endless bull run.

Rising inflation, supply chain disruptions, geopolitical tensions, and the specter of interest rate hikes by central banks are casting shadows over the market’s sunny disposition. Investors are grappling with conflicting signals, trying to decipher whether the current exuberance is sustainable or if we are teetering on the edge of a market cliff.

Technical Indicators:

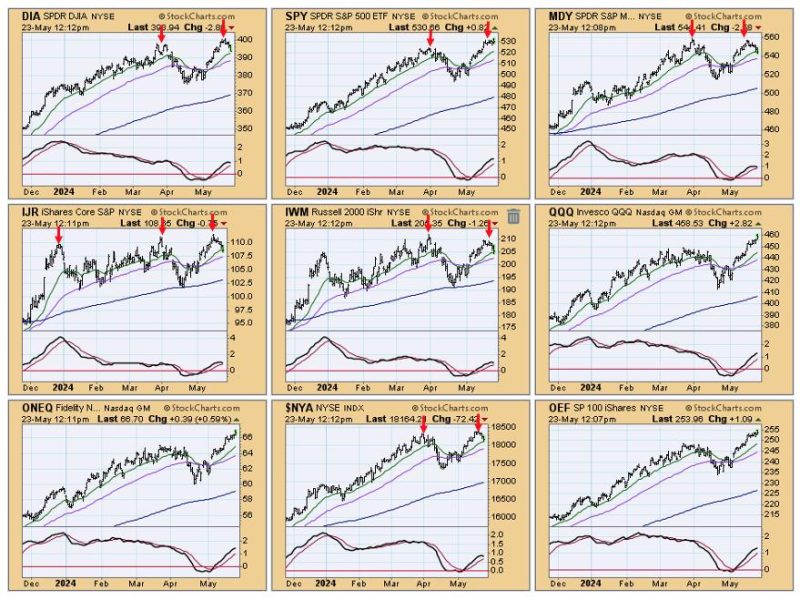

Turning our focus to the technical indicators, we see a mixed bag of signals that paint a nuanced picture of the market’s health. While momentum indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) may still signal bullish momentum in the short term, divergences and overbought conditions are flashing warning signs.

The recent spike in market volatility, as evidenced by the CBOE Volatility Index (VIX), is also a cause for concern. Market participants are nervously eyeing the velocity and magnitude of price swings, wary of a potential sudden shift in sentiment that could trigger a sharp market correction.

Sentiment and Psychology:

The psychological aspect of market dynamics cannot be overlooked. Investor sentiment, shaped by a mix of fear, greed, and herd mentality, often plays a crucial role in driving market trends. The current sentiment in the market seems to oscillate between FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, Doubt), creating a volatile cocktail of emotions.

The constant bombardment of news headlines, economic data releases, and geopolitical events further heighten investor anxiety, leading to knee-jerk reactions and irrational decision-making. As the market grapples with conflicting signals and narratives, it becomes increasingly challenging to navigate the treacherous waters of uncertainty.

Conclusion:

In conclusion, the market appears to be at a crossroads, teetering on the brink of a potential inflection point. While the bullish momentum of recent months has propelled equities to dizzying heights, the underlying vulnerabilities and uncertainties lurking beneath the surface cannot be ignored.

As investors and traders navigate these murky waters, it becomes crucial to exercise caution, conduct thorough analysis, and remain vigilant in monitoring key indicators and signals. While the market may appear to be toppy at present, the future remains uncertain and subject to the whims of countless variables.

Ultimately, whether the market is near its peak or still has room to grow remains to be seen. Only time will reveal the true nature of the Godzilla of market trends, and until then, it’s essential to tread carefully and stay informed.

By: [Your Name]