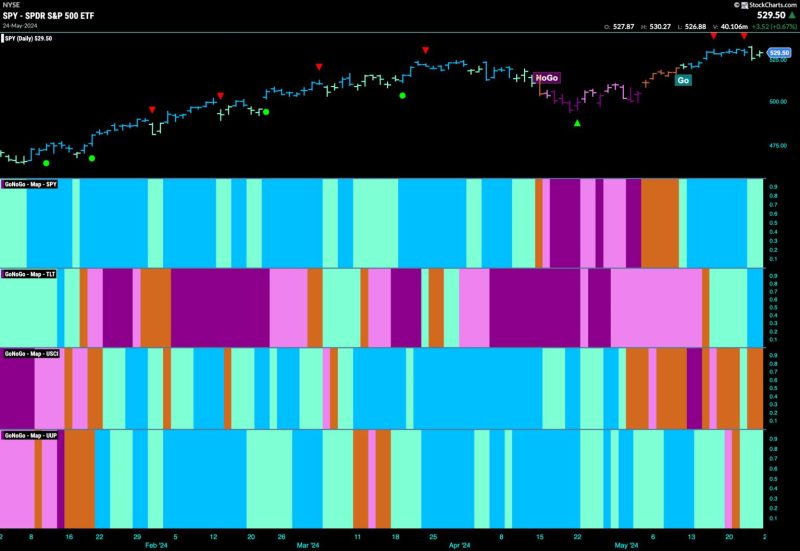

Equities Remain in Go Trend with Sparse Leadership from Tech and Utilities

The current state of equity markets continues to reflect a positive trend, with a mix of strengths and challenges. Technology and utility sectors have emerged as significant players, albeit with differing levels of influence. The broader market reflects a bullish sentiment, driven by several factors that have navigated the equities through recent turbulence. Let’s explore the dynamics shaping the equity landscape and the roles played by both tech and utilities in the current scenario.

**Market Dynamics:**

The equity markets are currently characterized by a go trend, with investors showing confidence and a willingness to participate. The optimism is underpinned by various factors, such as economic recovery, accommodative monetary policy, and robust corporate earnings. This collective momentum has propelled equities higher, with many indices hitting record highs. However, this bullish environment is not devoid of challenges, as concerns over inflation, tapering of stimulus measures, and geopolitical uncertainties loom large on the horizon.

**Tech Sector’s Leadership:**

The technology sector has been a key driver of market performance, with tech stocks witnessing strong gains and commanding significant market capitalization. Companies offering innovative solutions, cloud services, and digital transformation tools have been at the forefront of this surge. The pandemic-induced shift towards remote work and online services has further fueled demand for tech products and services. Despite regulatory scrutiny and concerns over valuations, tech stocks continue to attract investor interest, reflecting their pivotal role in shaping the new economy.

**Utilities Sector’s Contribution:**

On the other hand, the utilities sector has played a more subdued but stable role in the equity landscape. Known for its defensive characteristics and reliable dividend yields, utilities have provided a safe haven for investors seeking income and stability. The sector’s resilience during periods of volatility and economic uncertainty has made it an attractive choice for risk-averse investors. However, the utilities sector’s contribution to overall market gains has been relatively modest compared to the tech sector’s stellar performance.

**Challenges and Opportunities Ahead:**

As equities continue their upward trajectory, investors face a mix of challenges and opportunities. Inflationary pressures, rising interest rates, and global supply chain disruptions pose risks to market stability. Navigating these headwinds requires a strategic approach that factors in both sector-specific dynamics and broader market trends. While tech stocks offer growth potential but carry valuation concerns, utilities present stability but may underperform during periods of economic expansion.

**Conclusion:**

In conclusion, the current equity market environment remains conducive to growth, driven by a go trend supported by strong fundamentals and investor optimism. The tech sector’s leadership and the utilities sector’s stability represent contrasting but complementary forces shaping market dynamics. Understanding the roles played by these sectors and their implications is crucial for investors seeking to capitalize on the prevailing market conditions. As the market evolves, staying informed and adaptable will be key to navigating the changing landscape.