The Hindenburg Omen is a technical analysis indicator that is used to predict market crashes. It takes its name from the famous Hindenburg airship disaster of 1937, symbolizing the potential for catastrophic events in the stock market. When the Hindenburg Omen is triggered, it serves as an initial sell signal, indicating that market conditions are ripe for a major downturn.

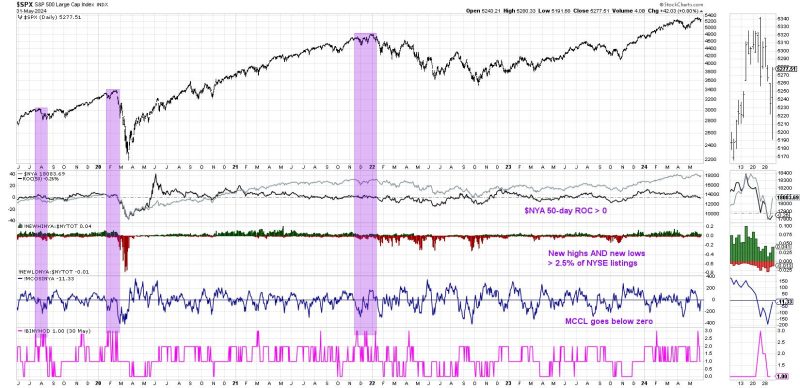

The criteria for the Hindenburg Omen include a series of technical signals occurring simultaneously within a specific time frame. These signals include a high number of both new highs and new lows on the stock exchange, as well as a rising 10-week moving average and other factors. When these conditions are met, it suggests that market internals are weakening, and a market crash may be on the horizon.

While the Hindenburg Omen has gained attention for its ominous name and potential predictive power, some analysts argue that its track record is mixed. Critics point out that the indicator has produced false signals in the past, leading traders to make premature or incorrect investment decisions. Additionally, the market is complex and influenced by a wide range of factors, making it challenging to rely solely on one indicator for making trading decisions.

It is important for investors to consider the Hindenburg Omen in the broader context of market analysis. While it can serve as a warning sign of potential trouble ahead, it is essential to use it in conjunction with other indicators and fundamental analysis to make well-informed investment decisions. Market sentiment, economic data, geopolitical events, and other factors all play a role in shaping market dynamics, and no single indicator can provide a complete picture of what lies ahead.

Ultimately, the Hindenburg Omen is just one tool in a trader’s toolkit, and its interpretation should be approached with caution and skepticism. While it may offer valuable insights into market conditions, it is not a foolproof signal of an imminent market crash. By combining the Hindenburg Omen with other technical and fundamental analysis techniques, investors can gain a more comprehensive understanding of market trends and make more informed decisions about their portfolios.