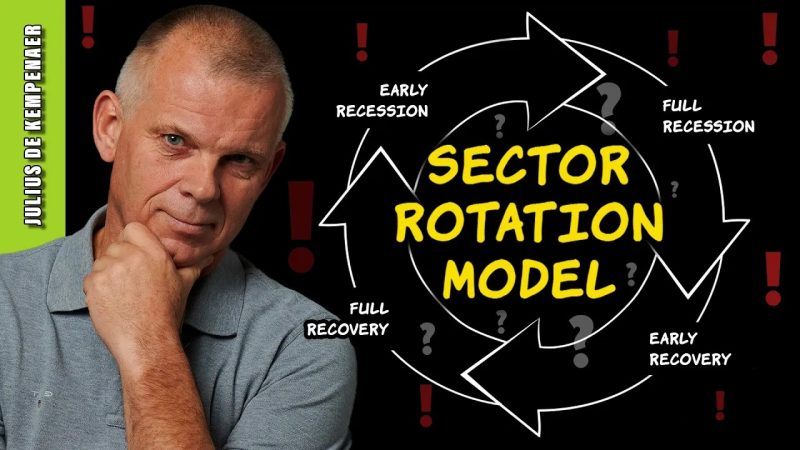

Sector rotation is a phenomenon that occurs in financial markets where money flows from one sector to another based on various economic indicators and market conditions. Investors and analysts closely monitor sector rotation as it can provide valuable insights into the overall health of the market and signal potential changes in market direction.

The recent performance of the sector rotation model has been sending warning signals to investors, prompting a closer examination of current market conditions. The model serves as a tool to gauge which sectors are experiencing upward momentum and which ones are losing favor among investors.

One of the key indicators used in the sector rotation model is relative strength, which measures the performance of one sector against another. A sector with strong relative strength is likely to outperform other sectors in the near future, while a sector with weak relative strength may underperform.

In recent months, the sector rotation model has been showing signs of weakness in certain sectors, particularly in industries such as consumer discretionary, technology, and communication services. These sectors, which have been among the top performers in the past, are now facing headwinds that indicate a potential shift in investor sentiment.

One possible explanation for the warning signals in the sector rotation model could be related to changing macroeconomic conditions. Factors such as rising interest rates, inflation concerns, and geopolitical tensions can significantly impact sector performance and cause investors to reallocate their capital to more defensive sectors.

For investors, keeping a close eye on sector rotation can help them make informed decisions about their portfolios and asset allocations. By understanding which sectors are gaining strength and which ones are weakening, investors can adjust their positions accordingly to take advantage of emerging opportunities or protect their portfolios from potential risks.

In conclusion, the sector rotation model serves as a useful tool for investors to navigate the complexities of financial markets and stay ahead of changing trends. By paying attention to warning signals and understanding the underlying factors driving sector performance, investors can position themselves for success in an ever-evolving market environment.