In the realm of stock markets, one common term that investors often come across is relative strength. Understanding and utilizing relative strength can offer valuable insights into the performance and potential of various stocks. This article will delve into the concept of relative strength and its significance in making informed investment decisions.

Relative strength refers to a stock’s performance compared to its peers or a particular benchmark index. This metric helps investors identify stocks that are outperforming the market or their industry counterparts, indicating strong potential for continued growth. By evaluating relative strength, investors can pinpoint opportunities to capitalize on stocks that are exhibiting strength and resilience in various market conditions.

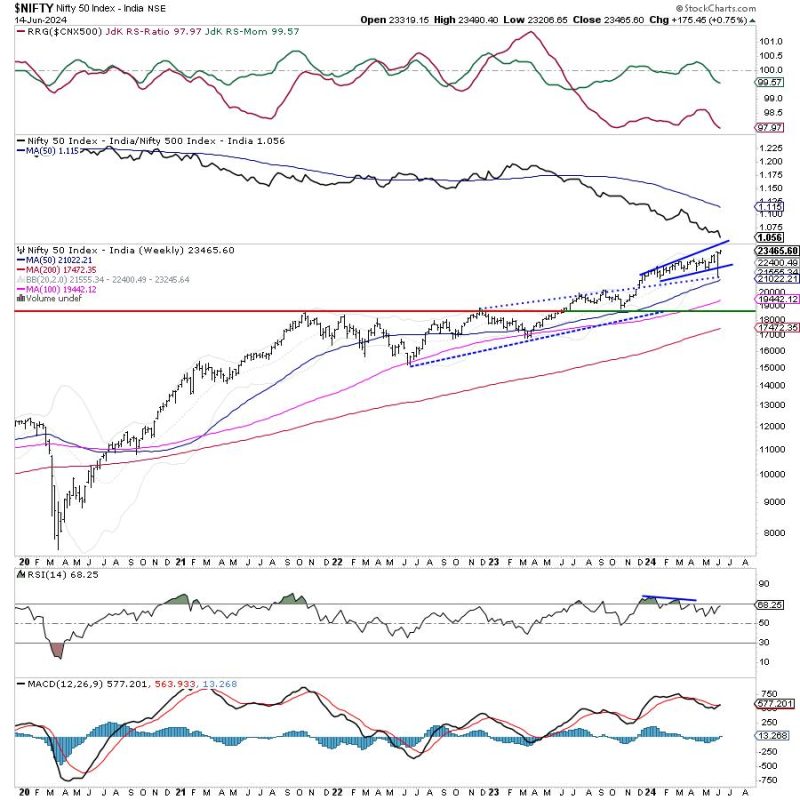

It is essential to note that relative strength analysis is a technical indicator that helps assess the momentum and trend of individual stocks. Relative strength is typically calculated using various technical tools and indicators, such as relative strength index (RSI), moving averages, and price performance comparisons. By examining these metrics, investors can identify stocks that are on an upward trajectory and potentially offer profitable returns.

When conducting relative strength analysis, investors look for stocks that are consistently outperforming their peers or a benchmark index over a specified period. These stocks are likely to possess strong underlying fundamentals and favorable market sentiment, making them attractive investment opportunities. By focusing on stocks with robust relative strength, investors can build a diversified portfolio with high-growth potential and reduced risk exposure.

One effective way to leverage relative strength analysis is by incorporating it into a broader investment strategy, such as momentum investing or sector rotation. Momentum investing involves capitalizing on the strength of trending stocks, while sector rotation aims to identify sectors that are poised for growth based on relative strength analysis. By integrating relative strength into these strategies, investors can enhance their chances of achieving superior returns and optimizing their portfolio performance.

In conclusion, relative strength analysis is a valuable tool for investors seeking to identify high-potential stocks and make informed investment decisions. By evaluating a stock’s performance relative to its peers and benchmark index, investors can uncover opportunities for maximizing returns and minimizing risks. Incorporating relative strength analysis into an investment strategy can help investors navigate the complexities of the stock market and build a well-rounded portfolio tailored to their financial goals.