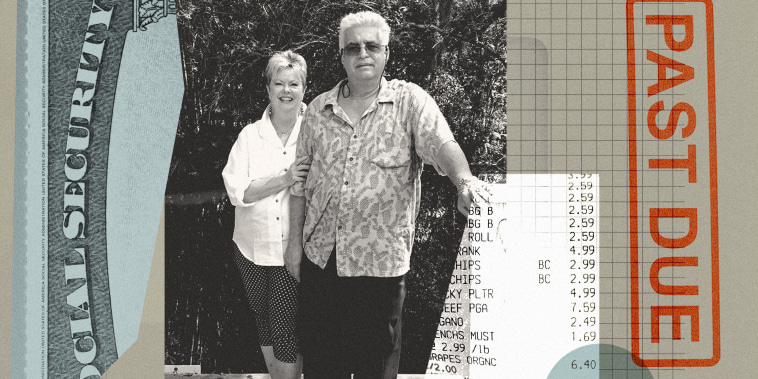

In the digital era, life after retirement can be a delicate balancing act for many individuals. It is not uncommon to hear stories of retirees enduring financial hardships, trying to make ends meet on fixed incomes. Such is the case for one Florida retiree who found herself in a challenging situation, struggling to maintain her financial stability in her golden years.

Adjusting to a monthly budget of $2,400, after years of a significantly higher income, can be a daunting task. This retiree’s savings were drained more quickly than anticipated, leaving her with limited resources to cover her expenses. With each passing month, the financial strain became more pronounced, forcing her to make difficult choices between essential needs and discretionary spending.

While retirement is meant to be a time of relaxation and enjoyment, financial constraints can cast a shadow over this phase of life. The retiree’s predicament exemplifies the importance of effective financial planning and prudent decision-making. In hindsight, she acknowledged that a more strategic approach to retirement savings could have improved her current situation.

Living on a fixed income requires careful management of expenses and prioritization of necessities. In this case, the retiree had to forego certain luxuries and entertainment activities that she enjoyed in the past. Instead, she focused on essentials such as housing, food, healthcare, and transportation, ensuring that these fundamental needs were met within her budget constraints.

Despite the challenges she faced, the retiree maintained a positive outlook and sought ways to make the most of her financial situation. By adopting a frugal lifestyle and seeking opportunities to supplement her income through part-time work or freelance gigs, she was able to alleviate some of the financial pressure and regain a sense of control over her finances.

The retiree’s story serves as a cautionary tale for individuals approaching retirement age. Proper financial planning, including saving diligently and exploring investment options, is crucial to ensure a comfortable and secure retirement. By making informed decisions early on and being proactive about managing finances, retirees can avoid the stress and uncertainty that often accompany limited financial resources in later years.

In conclusion, the challenges faced by the Florida retiree underscore the importance of financial preparedness and prudent decision-making in retirement. With careful planning, budgeting, and a willingness to adapt to changing circumstances, retirees can safeguard their financial well-being and enjoy a more secure and fulfilling post-work life.