In the world of finance and investing, technical analysis plays a crucial role in determining potential trends in the stock market. One popular chart pattern that traders frequently look for is the double top pattern. This pattern is particularly relevant when analyzing the performance of exchange-traded funds (ETFs) like the iShares Semiconductor ETF (SMH). As we delve into a deeper analysis of the double top pattern on the SMH ETF, we uncover key insights that can help investors make informed decisions.

The double top pattern is a bearish reversal pattern that occurs after an extended uptrend. It is characterized by two peaks at approximately the same price level, separated by a trough or a valley in between. This pattern signals a potential trend reversal from bullish to bearish, as it indicates that the bulls are losing momentum and the bears may be gaining control. In the case of the SMH ETF, the occurrence of a double top pattern could suggest a forthcoming downtrend in the semiconductor sector.

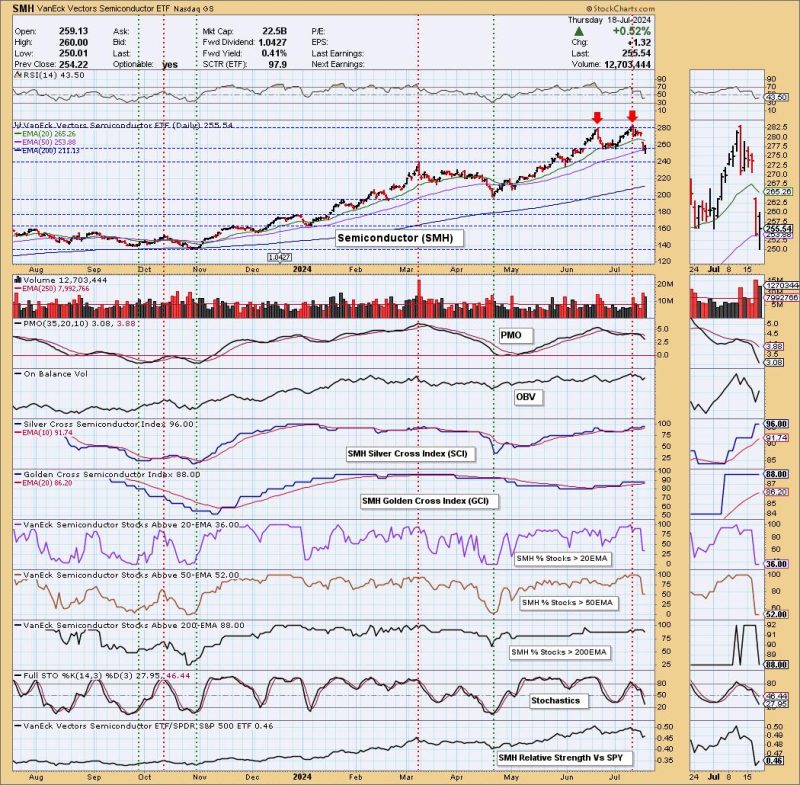

When examining the chart of the SMH ETF, we can observe the formation of a double top pattern. The first peak represents a significant high point in the ETF’s price, followed by a temporary decline before reaching the second peak at a similar price level. The trough or valley between the two peaks serves as a support level that, if broken, could confirm the validity of the double top pattern and signal a potential downtrend in the SMH ETF.

To make a more informed assessment of the double top pattern on the SMH ETF, it is essential to consider additional technical indicators and signals. Volume analysis can provide valuable insights into the strength of the pattern, as increasing volume during the formation of the second peak may validate the bearish reversal. Additionally, monitoring indicators such as the Relative Strength Index (RSI) and moving averages can help confirm the signal provided by the double top pattern.

It is important to note that while the double top pattern on the SMH ETF suggests a bearish outlook for the semiconductor sector, it is not a foolproof indicator of future price movements. Traders and investors should exercise caution and consider other fundamental and technical factors before making any investment decisions based solely on this pattern.

In conclusion, the double top pattern on the iShares Semiconductor ETF (SMH) presents a potential trading opportunity for investors looking to capitalize on a bearish reversal in the semiconductor sector. By understanding the characteristics of this pattern and incorporating additional technical analysis, traders can better gauge the likelihood of a downtrend in the SMH ETF. As with any trading strategy, thorough research and risk management are essential to navigating the complexities of the stock market successfully.