In the wake of recent economic events, there has been an air of uncertainty surrounding the Federal Reserve and its impact on the financial well-being of the public. The Federal Reserve, often credited with managing the country’s monetary policy and ensuring economic stability, is now under scrutiny for potentially creating a nightmare scenario that could have lasting repercussions on the economy.

One of the primary concerns raised in recent discussions is the risk posed by the Federal Reserve’s extensive bond-buying program. The unprecedented scale of these purchases has raised fears of inflation, as the increased money supply may lead to a decrease in the value of the dollar and a subsequent rise in prices. Critics argue that the Federal Reserve’s actions could trigger a self-reinforcing cycle of inflation, as consumers may expect prices to rise and adjust their behavior accordingly, further driving up inflation.

However, the Federal Reserve has defended its bond-buying program as a necessary tool to support the economy during times of crisis. By purchasing government bonds and mortgage-backed securities, the Federal Reserve aims to lower long-term interest rates, stimulate borrowing and investment, and promote economic growth. In their view, the potential benefits of this program outweigh the risks of inflation, and they remain committed to supporting the economy through these measures.

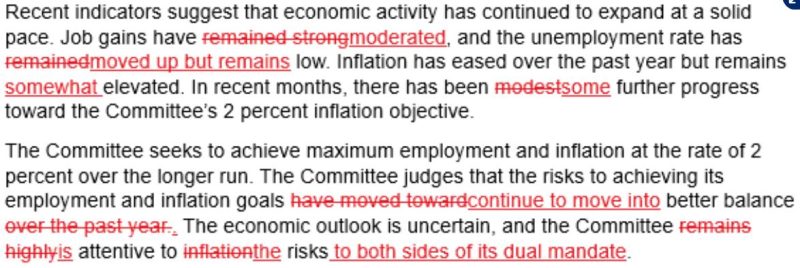

Furthermore, the Federal Reserve’s communication strategy has also come under scrutiny in recent months. Critics argue that the central bank’s guidance on future monetary policy actions has been unclear and inconsistent, leading to confusion and volatility in financial markets. The lack of transparency and predictability in the Federal Reserve’s messaging has sown doubts among investors and the public, exacerbating uncertainty about the future direction of the economy.

In response to these criticisms, Federal Reserve officials have emphasized the importance of flexibility and data-dependence in their decision-making process. They argue that the evolving nature of the economic landscape necessitates a nimble and adaptable approach to monetary policy, and that clear communication is essential to guiding expectations and shaping market behavior. Moving forward, the Federal Reserve is committed to enhancing its transparency and improving its communication strategy to better align market perceptions with policy intentions.

In conclusion, the Federal Reserve finds itself at a critical juncture, navigating a delicate balance between supporting the economy and managing the risks of inflation. While critics raise valid concerns about the potential pitfalls of the central bank’s actions, the Federal Reserve maintains that its policies are necessary to safeguard economic stability and promote growth. By engaging in open dialogue with stakeholders and refining its communication strategy, the Federal Reserve seeks to mitigate uncertainty and build public trust in its decision-making process.