In the financial realm, various indicators hold the key to unlocking potential market behaviors and trends. Among these indicators, the breadth indicator stands out as a valuable tool for investors seeking insight into the overall health of the market. This breadth indicator, often used in technical analysis, offers a broad view of the market by examining the number of stocks advancing versus declining.

When analyzing market breadth, investors typically look at metrics such as the advance-decline line, which tracks the number of advancing stocks minus declining stocks on a given day. A rising advance-decline line indicates strength in the market, suggesting that a broad array of stocks is participating in the upside movement. Conversely, a declining advance-decline line may signal weakness and potential downside risk.

The breadth indicator acts as a barometer for market sentiment, reflecting whether the prevailing trend is sustainable or in danger of reversal. By monitoring market breadth, investors can gauge the level of participation across various stocks and sectors. A healthy market typically sees strong participation across a wide range of stocks, indicating a robust and sustainable uptrend.

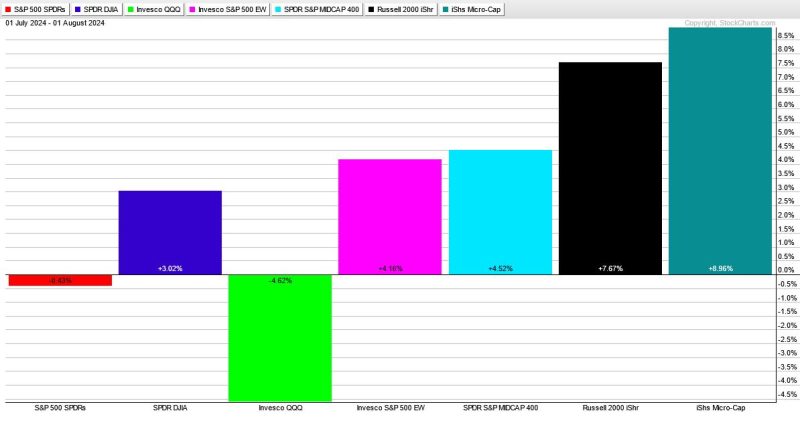

Recent data related to the breadth indicator points to potential downside risk in the market. With a notable skew towards declining stocks, the market breadth suggests that the current rally may be losing steam. This could signify a shift in sentiment among investors, prompting a reevaluation of market positions and risk exposure.

While a bearish breadth indicator may raise concerns for some investors, it also presents a potential opportunity for those with a contrarian mindset. Market corrections and pullbacks can create buying opportunities for savvy investors looking to capitalize on undervalued assets. By conducting thorough research and identifying fundamentally sound companies that have been unjustly affected by market sentiment, investors can position themselves for potential gains when the market sentiment eventually shifts.

In conclusion, market breadth indicators play a crucial role in assessing the health and direction of the market. By monitoring the breadth indicator and understanding its implications, investors can make informed decisions and adapt their investment strategies accordingly. While a bearish breadth indicator may signal potential downside risk, it also presents opportunities for contrarian investors to capitalize on undervalued assets. Ultimately, staying informed and using tools like the breadth indicator can help investors navigate the dynamic landscape of the financial markets with confidence and precision.