Market sentiment is a key factor in determining the direction of financial markets. Investors and traders often use various indicators to gauge market sentiment, helping them make informed decisions about their investments. In the current financial landscape, three market sentiment indicators have confirmed a bearish phase, indicating a potential downturn in the markets.

The first indicator pointing towards a bearish market sentiment is the Fear & Greed Index. This widely followed indicator combines various market factors to provide a single reading that reflects whether investors are feeling fearful or greedy. A high reading on the Fear & Greed Index indicates that investors are overly optimistic and may be subject to irrational exuberance. Conversely, a low reading suggests that investors are fearful and may be more likely to sell off assets.

Another crucial indicator signaling a bearish sentiment is the Put/Call Ratio. This ratio compares the number of put options (which increase in value when the underlying asset falls) to call options (which increase in value when the underlying asset rises). A high put/call ratio suggests that investors are purchasing more put options, indicating a higher level of pessimism in the market. Conversely, a low put/call ratio indicates that investors are more optimistic about the market’s direction.

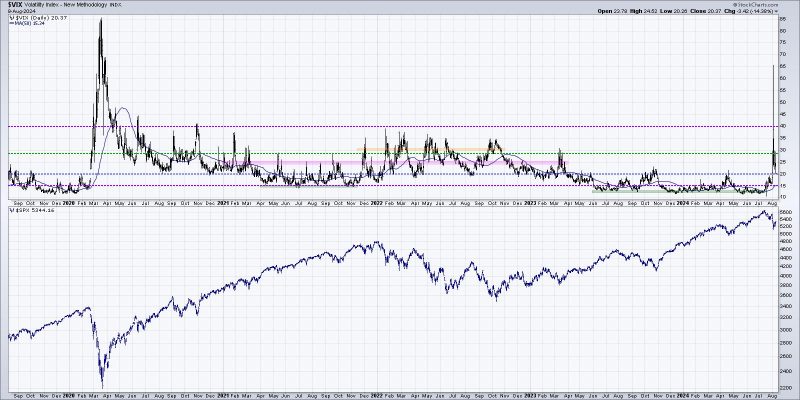

The third indicator corroborating a bearish phase is the VIX, also known as the volatility index. The VIX measures the market’s expectation of future volatility and is often referred to as the fear gauge. A high VIX reading suggests that investors are anticipating increased market volatility and are hedging against potential downside risks. A low VIX reading, on the other hand, indicates that investors are complacent and may underestimate market risks.

By analyzing these three market sentiment indicators together, investors can gain valuable insights into the prevailing sentiment in the markets. A bearish phase, as confirmed by these indicators, suggests that investors are cautious and may be more inclined to sell off risky assets. It is essential for investors to consider these indicators alongside other fundamental and technical factors when making investment decisions.

In conclusion, monitoring market sentiment indicators is crucial for investors seeking to navigate the financial markets successfully. The Fear & Greed Index, Put/Call Ratio, and VIX are valuable tools that can provide insights into prevailing market sentiment. In the current environment, these indicators are signaling a bearish phase, indicating a potential downturn in the markets. By staying informed and considering these indicators alongside other market factors, investors can make more informed decisions and better position themselves to mitigate risks and capitalize on opportunities in the markets.