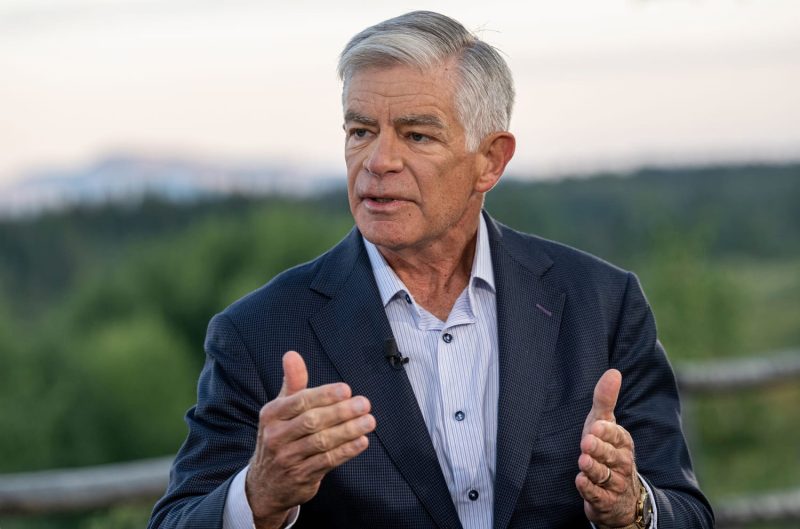

Philadelphia Fed President Patrick Harker Advocates for Interest Rate Cut in September

Philadelphia Fed President Patrick Harker recently made a bold advocacy for an interest rate cut in September. His stance has raised eyebrows among financial analysts and the wider economic community, as interest rate adjustments are often a sensitive and significant tool in managing the economy. Harker’s reasoning behind this call for a rate cut raises important questions and highlights potential challenges in the current economic landscape.

Harker’s primary argument for an interest rate cut is rooted in concerns over the economic impact of the ongoing trade tensions between the US and China. The escalating trade war has sparked fears of a global economic slowdown and has already affected various sectors, including manufacturing and agriculture. Harker believes that lowering interest rates could help mitigate some of the negative consequences of these trade disputes and provide a boost to the economy.

Moreover, Harker’s call for an interest rate cut reflects his cautious approach to monetary policy in response to the changing economic conditions. The Federal Reserve has been closely monitoring indicators such as inflation, employment, and consumer spending to gauge the health of the economy. Harker’s proactive stance suggests that he is keen on preemptively addressing any potential challenges before they escalate into larger problems.

However, Harker’s advocacy for an interest rate cut is not without its critics. Some experts argue that lowering interest rates could have unintended consequences, such as fueling inflation or creating asset bubbles. Moreover, the efficacy of interest rate adjustments in addressing broader economic issues, such as trade tensions, remains a subject of debate among economists.

In addition to the domestic economic considerations, Harker’s call for an interest rate cut also reflects a broader global economic context. The interconnected nature of the global economy means that actions taken by central banks in one country can have ripple effects across the world. As such, Harker’s proposal for an interest rate cut in September could potentially impact not only the US economy but also the global economic landscape.

Overall, Harker’s advocacy for an interest rate cut in September highlights the complex interplay of factors that central bankers must consider when making decisions on monetary policy. While his reasoning is centered on addressing immediate challenges such as trade tensions, the implications of such a move extend far beyond the borders of the US. As the Federal Reserve weighs its options in the coming months, the economic community will be closely watching to see how these decisions shape the future trajectory of the economy.