The interpretation of market trends is a critical aspect of successful trading and investing. Analysts examine a variety of tools and indicators to gauge market sentiment and direction. One such tool that provides valuable insights into the relative strength of assets is the Relative Rotation Graph (RRG).

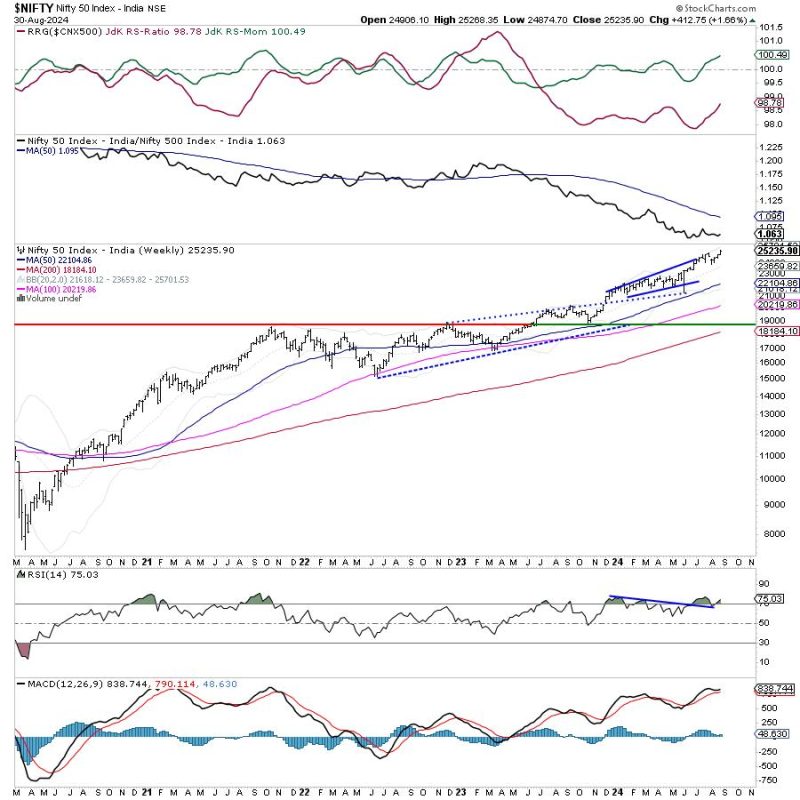

The RRG helps analysts visualize the relative performance of various securities against a chosen benchmark. By mapping the rotation of assets on a graph, investors can quickly identify which securities are outperforming or underperforming the benchmark. In the context of the Indian stock market, the Nifty index is often used as the benchmark against which the performance of individual stocks or sectors is measured.

The article on Godzilla Newz discusses the application of RRG in analyzing the Nifty index and its constituent stocks. The article highlights the importance of staying abreast of the overall market trend while also recognizing the divergent movements of individual stocks. The RRG in this case shows a distinctly defensive setup, indicating that certain sectors or stocks might be facing headwinds compared to the broader market.

For investors and traders, understanding the RRG can provide valuable insights into portfolio construction and risk management. By identifying assets with strong momentum and relative strength, investors can tilt their portfolios towards potential outperformers. Conversely, recognizing assets in a weak position on the RRG can help investors avoid potential pitfalls or position defensively during uncertain market conditions.

While the RRG is a powerful tool for analyzing market trends, it is essential to complement its insights with a holistic view of the market environment. Technical analysis, fundamental research, and macroeconomic factors all play a role in shaping market dynamics. By integrating multiple sources of information, investors can make more informed decisions and navigate the complexities of the financial markets with greater confidence.

In conclusion, the RRG is a valuable tool for assessing the relative strength of assets within a given market. By monitoring the rotation of securities on the graph, investors can gain insights into which assets are likely to outperform or underperform the benchmark. When used in conjunction with other analytical tools, the RRG can help investors make more informed decisions and navigate the ever-changing landscape of the financial markets.