The market sentiment for Nifty appears to be shifting as early signs of a potential disruption of the uptrend are emerging. Investors are advised to proceed with caution and closely monitor their positions. Here’s a breakdown of the key factors contributing to this change in sentiment:

Technical Indicators:

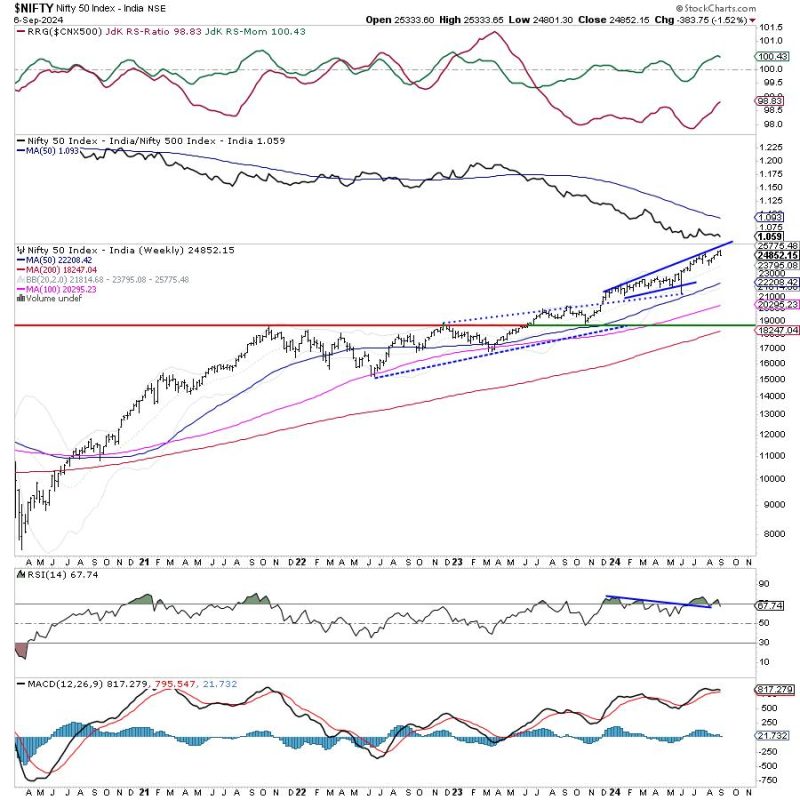

Technical analysis suggests that Nifty is showing signs of weakening as it approaches a crucial resistance level. The Relative Strength Index (RSI) and Moving Averages are indicating a potential reversal in the uptrend. Traders are advised to pay close attention to these indicators for a clearer picture of market direction.

Market Volatility:

Volatility in the market has increased in recent days, which can be seen as a warning sign for investors. Sharp swings in prices and increased uncertainty could lead to a potential downturn in the near term. Traders should be prepared for heightened volatility and adjust their risk management strategies accordingly.

Global Factors:

External factors such as geopolitical tensions, economic data releases, and global market trends can also impact the trajectory of Nifty. Investors should keep a close eye on international developments and their potential implications for the Indian market. Any adverse news could trigger a sell-off and disrupt the current uptrend.

Sectoral Performance:

Different sectors within Nifty are likely to respond differently to the changing market conditions. Investors should diversify their portfolios and focus on sectors that show resilience in the face of a potential market downturn. Conducting in-depth research on sectoral performance and selecting stocks strategically can help mitigate risks during uncertain times.

Risk Management:

In times of market uncertainty, risk management becomes paramount. Traders should set stop-loss orders, diversify their portfolio, and avoid making emotional decisions based on short-term fluctuations. Maintaining a disciplined approach to trading and investing can help navigate volatile market conditions effectively.

Overall, the early signs of a potential disruption of the uptrend in Nifty call for a cautious approach from investors. By closely monitoring technical indicators, assessing market volatility, staying informed about global factors, focusing on resilient sectors, and implementing sound risk management strategies, investors can navigate the market uncertainties and protect their investment portfolios. It is essential to stay vigilant and adaptable in order to thrive in a dynamic market environment.