In the world of investing and the stock market, the movement of interest rates plays a critical role in shaping investor sentiment and stock performance. Rate cuts by central banks are often met with mixed reactions from the investment community, with opinions varying on whether they are bullish or bearish for stock performance. Let’s delve deeper into this topic to uncover the truth behind rate cuts and their impact on the stock market.

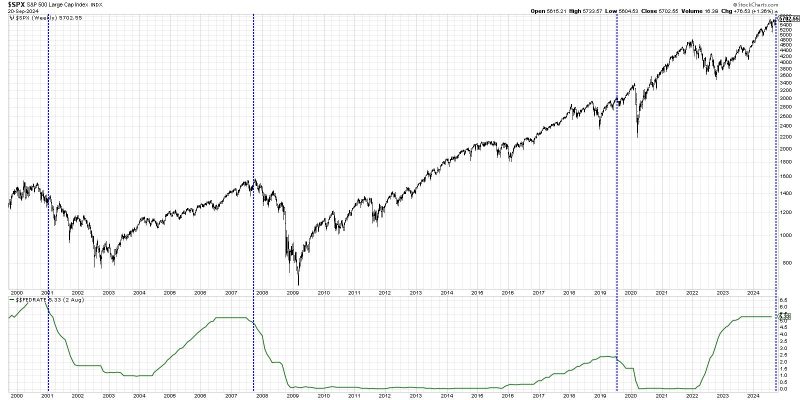

Historically, central banks use interest rate cuts as a tool to stimulate economic growth and increase liquidity in the financial system. Lower interest rates make borrowing cheaper, encouraging businesses and individuals to spend and invest, which can boost overall economic activity. In theory, this should translate to higher corporate earnings and stock prices, making rate cuts appear bullish for the stock market.

However, the real-world relationship between rate cuts and stock performance is not always straightforward. Several factors come into play that can influence the market’s reaction to a rate cut. For instance, the timing and magnitude of the rate cut, as well as the underlying economic conditions, can greatly impact how investors perceive the move.

One key consideration is the market’s expectations regarding rate cuts. If a rate cut has been widely anticipated and already priced into stock prices, the actual announcement may not have a significant impact on market performance. Conversely, a surprise rate cut, especially during times of economic uncertainty, can lead to a more pronounced market reaction.

Moreover, the reason behind the rate cut can also shape its impact on stock performance. Rate cuts driven by concerns over economic weakness or financial instability may be interpreted as a bearish signal by investors, reflecting broader concerns about the health of the economy. On the other hand, rate cuts aimed at proactively supporting economic growth in a healthy economy may be viewed more positively, potentially fueling a bullish market sentiment.

It is essential for investors to consider the broader economic context when assessing the implications of rate cuts on stock performance. Factors such as inflation trends, unemployment rates, and global economic conditions can all influence how rate cuts are perceived by the market. Additionally, investors should be mindful of other market drivers, including corporate earnings, geopolitical events, and market sentiment, which can also shape stock performance independently of interest rate movements.

Ultimately, while rate cuts can have a meaningful impact on stock performance, they are just one piece of the puzzle in the complex world of investing. Successful investing requires a comprehensive understanding of economic trends, market dynamics, and individual company fundamentals. By taking a holistic approach and staying informed about key market drivers, investors can make more informed decisions about how rate cuts may affect their investment portfolios.