The article suggests that the outlook for the stock market remains uncertain, with investors closely watching the Nifty index for clues on future market trends. The Nifty’s recent pullback from record highs has raised concerns about the market’s direction, leading analysts to speculate on potential support levels and possible job losses. Despite these uncertainties, the broader market sentiment remains optimistic, driven by positive earnings reports and economic indicators.

Market volatility continues to be a key concern, with the potential for sudden spikes in prices leading to sharp market downturns. Traders are advised to remain cautious and monitor their positions closely, particularly in the current environment of heightened volatility. The article stresses the importance of risk management strategies to protect investments and navigate market uncertainties effectively.

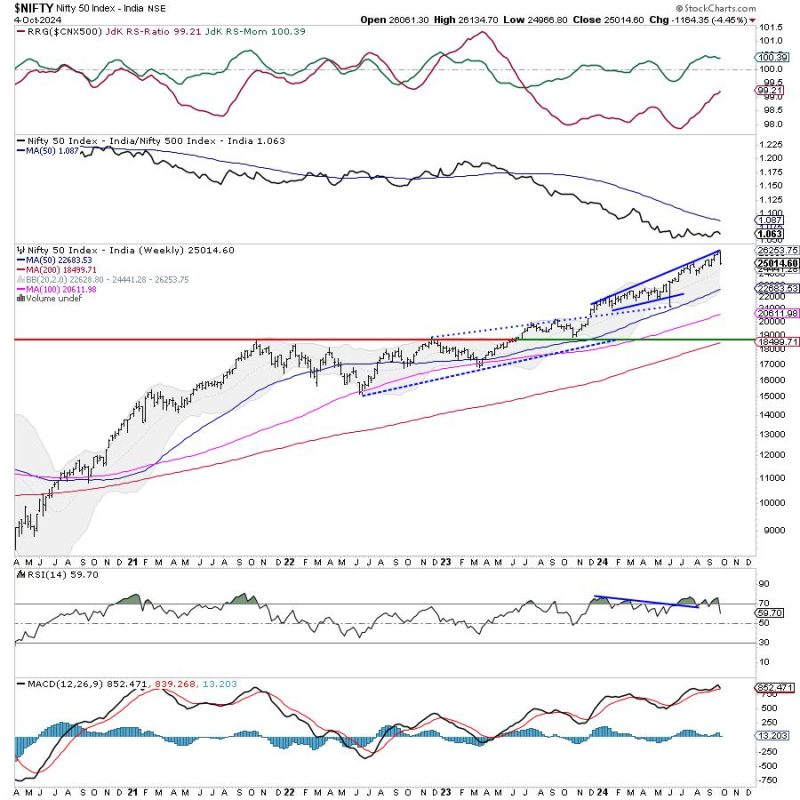

Technical analysis provides valuable insights into market trends and potential price movements, with key support and resistance levels serving as crucial reference points for traders. By analyzing historical data and market patterns, traders can make informed decisions and adjust their strategies accordingly. The Nifty’s current position on the charts suggests a critical level of support that could determine the market’s near-term trajectory.

Overall, the article emphasizes the importance of staying informed and proactive in navigating the dynamic stock market landscape. By paying attention to key indicators, monitoring market developments, and implementing risk management strategies, investors can position themselves effectively and capitalize on opportunities while mitigating potential risks. The article’s insights serve as a valuable resource for traders seeking to make informed decisions in the face of market uncertainties.