In the realm of financial markets and stock trading, it is imperative for investors and traders to not only keep a vigilant eye on current market trends but also to stay updated with key levels and indicators that could influence the trajectory of their investments. The Nifty index is one such crucial benchmark that often acts as a barometer for the broader market sentiment. As the Nifty consolidates, it becomes even more important for market participants to pay attention to certain levels that could play a decisive role in shaping future trends.

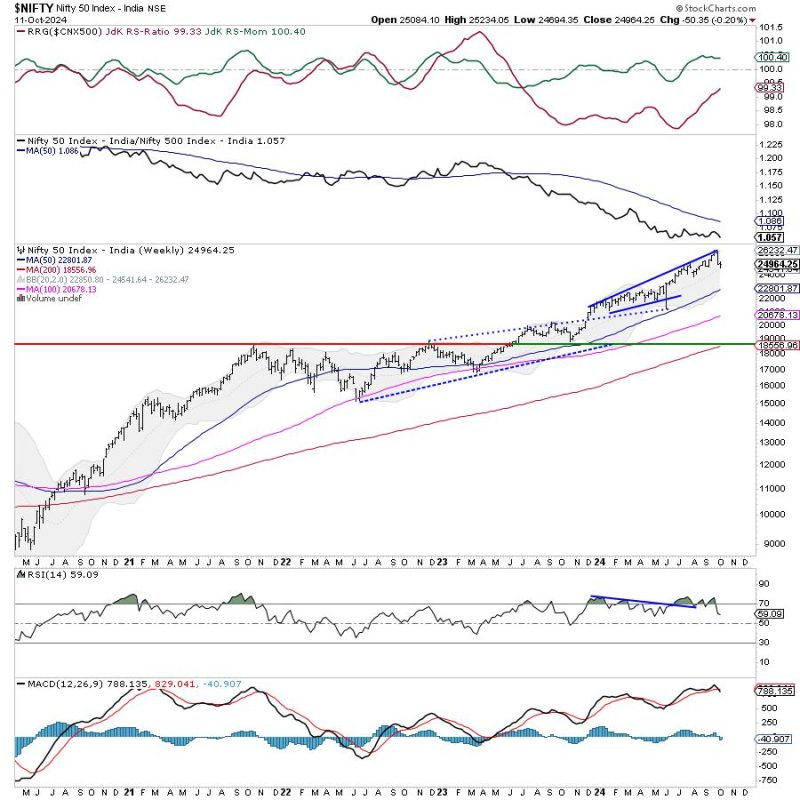

At the outset, traders should focus on the immediate support and resistance levels for the Nifty index. These levels serve as crucial pivot points that indicate the underlying strength or weakness in the market. By recognizing these levels and analyzing price action around them, traders can make informed decisions about their trades and positions.

Additionally, keeping a close watch on key technical indicators such as moving averages, relative strength index (RSI), and stochastic oscillators can provide valuable insights into the market dynamics. These indicators help traders gauge the momentum and strength of the market trend, enabling them to anticipate potential reversals or breakout opportunities.

Furthermore, macroeconomic factors and global events can also have a significant impact on the Nifty index and overall market sentiment. Geopolitical tensions, economic data releases, and central bank announcements are just a few examples of external factors that can influence investor behavior and market direction. Traders should stay abreast of such developments and adapt their strategies accordingly to mitigate risks and capitalize on opportunities.

In light of the current market environment characterized by consolidation and uncertainty, it is essential for traders to exercise caution and prudence in their decision-making process. Risk management should be a top priority, with traders setting clear stop-loss levels and position sizing guidelines to protect their capital.

In conclusion, while the Nifty consolidates, traders must remain vigilant and proactive in monitoring key levels, technical indicators, and external factors that could impact market dynamics. By staying informed and adopting a disciplined approach to trading, investors can navigate the market volatility with confidence and optimize their chances of success.