The article from GodzillaNewz presents a detailed analysis of the current market conditions, focusing on short-term bearish signals as investors prepare for a news-heavy week. The article highlights key factors contributing to the bearish sentiment in the market and provides insights into the potential impact of upcoming news events on market dynamics.

One of the primary reasons cited for the bearish outlook is the uncertain outlook surrounding key economic indicators, such as inflation and interest rates. The article points out that market participants are closely monitoring these indicators for clues about the future direction of monetary policy and overall economic health. Any surprises in these data points could potentially trigger sharp market reactions, leading to increased volatility and downside pressure on asset prices.

Moreover, the article acknowledges the upcoming news-heavy week as a critical juncture for markets around the globe. With various significant events on the horizon, including central bank meetings, economic data releases, and geopolitical developments, investors are bracing themselves for potential market-moving news. Any unexpected outcomes from these events could spark sharp market reactions, amplifying the current bearish sentiment prevalent in the markets.

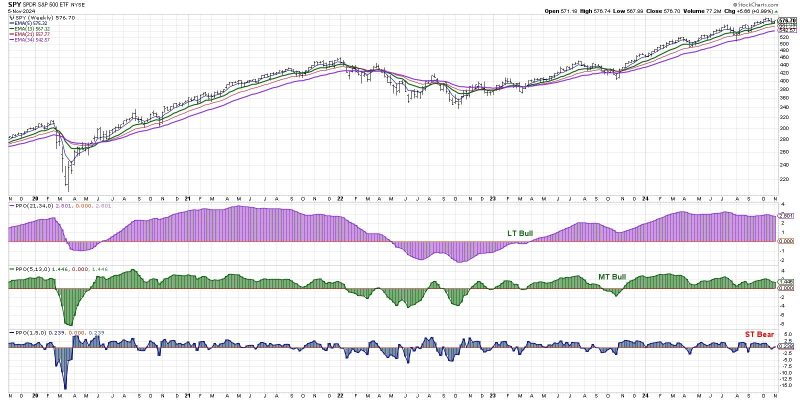

Furthermore, the article delves into the technical indicators that support the short-term bearish signal in the market. Analysts and traders are closely watching key technical levels and market patterns to gauge the strength of the current downtrend. The presence of bearish chart patterns and weakening technical signals suggest that market participants are positioning themselves for further downside potential in the near term.

In conclusion, while the market is currently facing short-term bearish pressures, the upcoming news-heavy week presents a pivotal moment for investors to reassess their positions and strategies. With a plethora of market-moving events on the horizon, staying informed and nimble in response to changing market conditions will be crucial for navigating the current volatility and uncertainty in the markets. By closely monitoring key economic indicators, technical signals, and news developments, investors can better position themselves to weather the storm and potentially capitalize on opportunities that arise in this dynamic market environment.