Secular Bull Market Continues But With Major Rotation

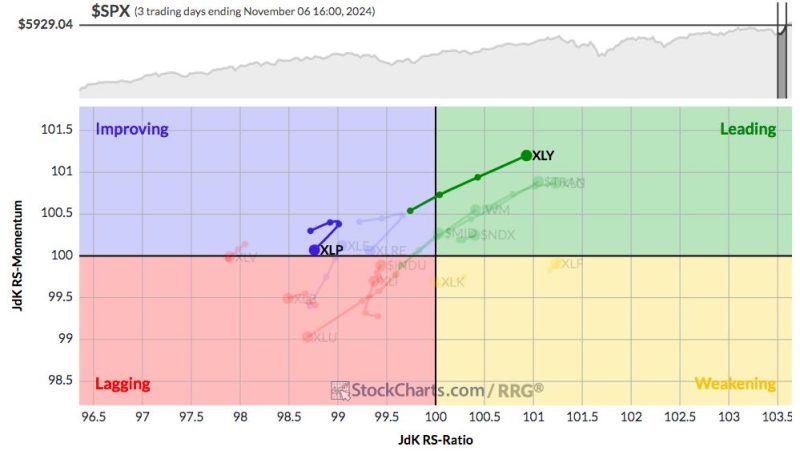

In the realm of financial markets, the concept of secular trends serves as a guidepost for investors seeking to decipher the broader trajectory of asset classes over extended periods. In the current landscape, the secular bull market appears to be pressing forward; however, a significant rotation within sectors is generating a dynamic investment environment.

The traditional sectors that have driven the bull market in recent years, such as technology and consumer discretionary, are now facing varying levels of headwinds. The unprecedented shift in consumer behavior due to the global health crisis has propelled the digital transformation, leading technology stocks to outperform. Meanwhile, consumer discretionary companies have experienced volatility due to changing spending patterns and unpredictable economic conditions.

Conversely, sectors that have traditionally lagged are now emerging as unexpected winners in this evolving landscape. The energy sector, which has historically struggled against the backdrop of environmental concerns and fluctuating commodity prices, has rebounded as global demand recovers. The surge in renewable energy investments and the increasing focus on sustainability have also bolstered the sector’s prospects.

Moreover, the financial sector, which has grappled with low-interest rates and regulatory challenges, is poised for a resurgence. The prospect of rising inflation and improved economic conditions could potentially boost the profitability of financial institutions, leading to renewed investor interest in the sector.

The healthcare sector, long regarded as a defensive play, has also showcased robust performance amid the pandemic. Companies involved in vaccine development, telemedicine, and healthcare technology have seen significant gains, highlighting the sector’s resilience and innovation.

Amid these sectoral shifts, investors must adapt their investment strategies to capitalize on emerging opportunities while managing risks effectively. Portfolio diversification, rigorous research, and a long-term perspective remain foundational principles for navigating the evolving market dynamics.

Furthermore, the importance of staying informed and monitoring macroeconomic trends cannot be overstated. Geopolitical developments, central bank policies, and global economic indicators can all influence market sentiment and asset prices, underscoring the need for a comprehensive market outlook.

In conclusion, while the secular bull market continues its upward trajectory, a major rotation within sectors is reshaping the investment landscape. By identifying emerging trends, reevaluating investment allocations, and maintaining a prudent approach to risk management, investors can position themselves to thrive in this dynamic environment. Adaptability, resilience, and a keen awareness of evolving market dynamics will be essential for navigating the complexities of the secular bull market in the years ahead.