Article:

The ATR Trailing Stop is a Powerful Tool for Trade Management and Trend Definition

Adjusting your trading approach in response to market conditions is essential to achieving success in the ever-changing world of investing. One tool that has gained popularity among traders for managing trades and defining trends is the ATR Trailing Stop method. By incorporating this approach into your trading strategy, you can effectively protect profits, minimize losses, and identify emerging trends.

The Average True Range (ATR) Trailing Stop is a technical indicator that helps traders determine the volatility of an asset. It provides valuable information on price movement, allowing traders to adjust their trade management techniques accordingly. By calculating the average true range over a specified period, the ATR Trailing Stop identifies the current volatility of an asset and establishes dynamic stop levels based on this data.

One of the key benefits of using the ATR Trailing Stop is its ability to adapt to changing market conditions. Unlike static stop-loss orders, which remain fixed regardless of market movement, the ATR Trailing Stop adjusts in real-time to reflect fluctuations in volatility. This dynamic nature allows traders to protect their profits by trailing stop levels at a distance proportional to the asset’s volatility, thereby locking in gains while still allowing for potential upside.

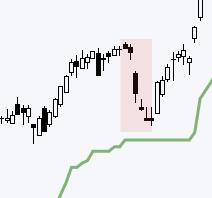

In addition to trade management, the ATR Trailing Stop can also be used to define trends in the market. By observing the relationship between price and the trailing stop levels, traders can identify when a trend is gaining strength or losing momentum. When an asset’s price remains consistently above the trailing stop, it suggests an uptrend, while prices consistently below the stop indicate a downtrend. This visual representation of trend dynamics can help traders make informed decisions on market entries and exits.

Implementing the ATR Trailing Stop into your trading strategy requires a clear understanding of how the indicator works and its implications for trade management. By incorporating this tool into your analysis, you can effectively manage risk, protect profits, and capitalize on emerging trends in the market. Whether you are a seasoned trader or just starting, the ATR Trailing Stop offers a versatile method for enhancing your trading performance and staying ahead of the curve.