The article linked discusses the market outlook for the Nifty and advises investors to guard profits and focus on stock-specific themes. In this regard, several key factors and strategies are highlighted to help navigate the market effectively.

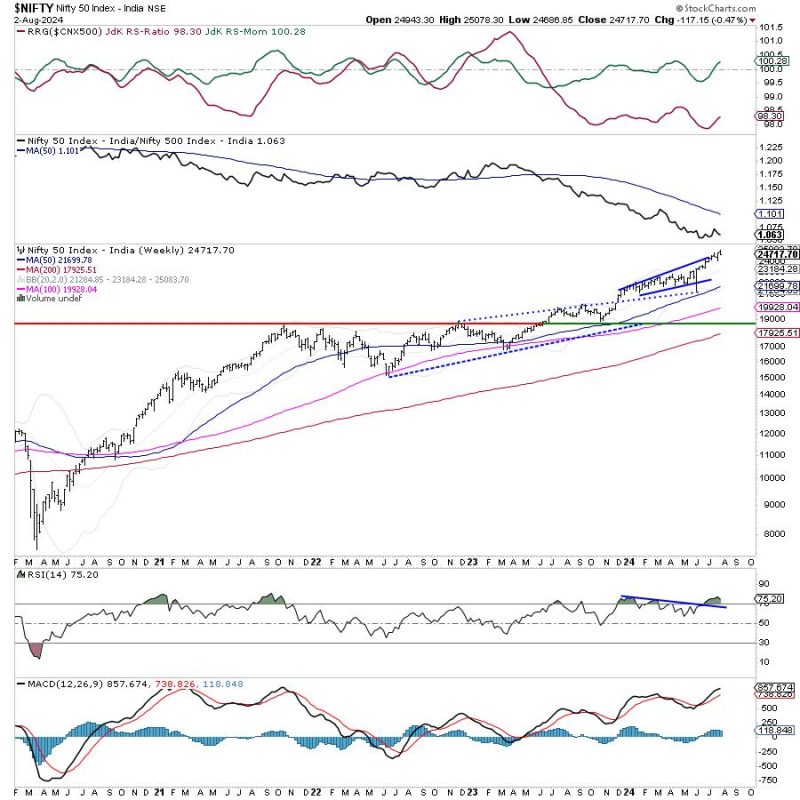

Firstly, technical analysis is cited as a crucial tool for traders to gauge the market trends and make informed decisions. By analyzing charts and patterns, investors can identify potential entry and exit points, thereby optimizing their profits and minimizing risks.

Secondly, the article emphasizes the importance of monitoring global cues and macroeconomic indicators. Factors such as international market trends, geopolitical events, and economic data releases can significantly impact the stock market. Staying abreast of these external factors allows investors to adjust their strategies accordingly and capitalize on emerging opportunities.

Furthermore, the article underscores the significance of diversification in investment portfolios. By spreading investments across different sectors and asset classes, investors can mitigate risks and improve overall returns. A well-diversified portfolio not only safeguards against market volatility but also allows for exposure to various growth opportunities.

In addition, the article advocates for a disciplined approach to trading. Establishing clear investment goals, adhering to predetermined risk management strategies, and maintaining a long-term perspective are essential for sustained success in the stock market. Emotions like greed and fear can cloud judgment, leading to impulsive decisions that may harm investment outcomes.

The article also discusses the importance of stock selection based on fundamental analysis. Evaluating company financials, growth prospects, management quality, and industry trends can help identify promising investment opportunities. Investing in fundamentally strong companies with growth potential provides a solid foundation for building a profitable portfolio.

Lastly, the article suggests staying informed through reputable sources and seeking advice from financial experts. Regularly monitoring market developments, seeking insights from industry professionals, and participating in educational programs can enhance investors’ knowledge and skills. Information symmetry is critical in making well-informed investment decisions.

In conclusion, the article provides valuable insights into navigating the stock market effectively by focusing on technical analysis, monitoring global cues, diversifying portfolios, maintaining discipline, conducting fundamental analysis, and staying informed. By incorporating these strategies, investors can optimize their returns, mitigate risks, and succeed in the dynamic world of stock trading.