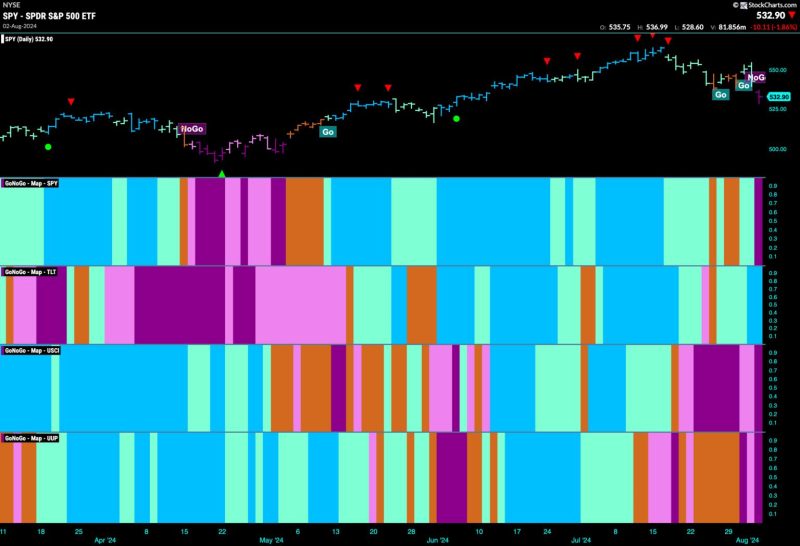

Stocks Get Defensive as Market Index Enters No-Go Zone

The article from GodzillaNewz highlights the current shift towards defensive stocks as the market index enters a volatile phase. As investors navigate through uncertain times, the appeal of defensive stocks has grown significantly. These stocks have become a safe haven for many investors looking to protect their portfolios from the risks associated with a turbulent market.

One key aspect mentioned in the article is the concept of a ‘No-Go Zone’ within the market index. This zone represents a period of heightened caution where market participants are urged to proceed with care. During such times, defensive stocks, which are known for their stable performance and ability to withstand market downturns, tend to outperform other sectors.

The article points out that in the current market environment, defensive stocks such as utilities, consumer staples, and healthcare companies have attracted increased interest from investors. These companies typically offer products and services that are essential to everyday life, making them less susceptible to economic fluctuations.

Moreover, the article emphasizes the importance of diversification during market volatility. By spreading investment across different sectors, asset classes, and geographies, investors can reduce risk and protect their portfolios from unforeseen events. This strategy aligns with the concept of defensive investing, where the focus is on preserving capital rather than taking on high levels of risk.

The author of the article also discusses the role of interest rates in shaping investment decisions during uncertain times. As central banks adjust interest rates to stabilize the economy, investors must adapt their strategies to capitalize on changing market conditions. Defensive stocks, with their steady dividends and resilient business models, can offer a sheltered haven in a climate of rising interest rates.

In conclusion, the article sheds light on the significance of defensive stocks in times of market turbulence. By recognizing the value of stability and predictability in uncertain times, investors can build a resilient portfolio that weathers market storms. The ‘No-Go Zone’ serves as a reminder for investors to exercise caution and seek refuge in defensive stocks to navigate through choppy waters successfully.