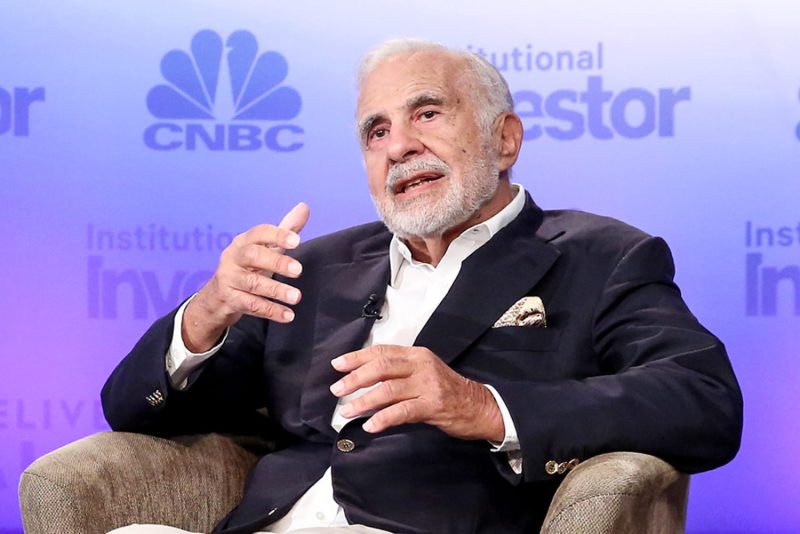

In the fast-paced world of finance and investing, the recent revelation of the Securities and Exchange Commission (SEC) charging billionaire investor Carl Icahn with allegedly concealing billions of dollars worth of stock pledges has sparked intense debate and concern among the investing community. The SEC’s accusations against Icahn, a prominent figure in the financial world, have raised questions about transparency and disclosure regulations in the financial markets.

The SEC’s enforcement action alleges that Icahn failed to disclose certain derivatives trades in various public companies in a timely manner, violating federal regulations that require the prompt disclosure of significant ownership positions. Derivatives, which are financial contracts that derive their value from an underlying asset, can have a substantial impact on the financial markets, making transparency in their trading crucial for maintaining market integrity.

Icahn, known for his activist investing style and strong track record of generating substantial returns for his investors, has built a reputation as a savvy and successful investor over the years. However, the SEC’s charges against him have raised concerns about potential conflicts of interest and the need for greater regulatory oversight in the financial industry.

The case against Icahn highlights the importance of regulatory compliance and adherence to disclosure requirements in the financial markets. Transparency and accountability are essential for maintaining investor confidence and ensuring the fairness and integrity of the markets. Investors rely on accurate and timely information to make informed decisions, and any attempt to conceal or manipulate critical data can undermine market trust and stability.

While Icahn has denied the allegations and vowed to fight the charges, the case serves as a reminder of the potential risks associated with opaque trading practices and the importance of regulatory oversight in safeguarding the interests of investors. The outcome of this legal battle will have far-reaching implications for the financial industry and may lead to increased scrutiny of high-profile investors and their trading activities.

In conclusion, the SEC’s charges against Carl Icahn for allegedly hiding billions of dollars worth of stock pledges have sparked a heated debate about transparency and accountability in the financial markets. The case underscores the need for strict adherence to disclosure requirements and the importance of regulatory oversight in safeguarding the integrity of the financial system. Investors and market participants will be closely monitoring the developments in this case, as its outcome could have significant implications for the future of investing and regulatory practices.