Broad-Based Stock Market Selloff: How to Position Your Portfolio

Understanding the Impact of a Broad-Based Stock Market Selloff

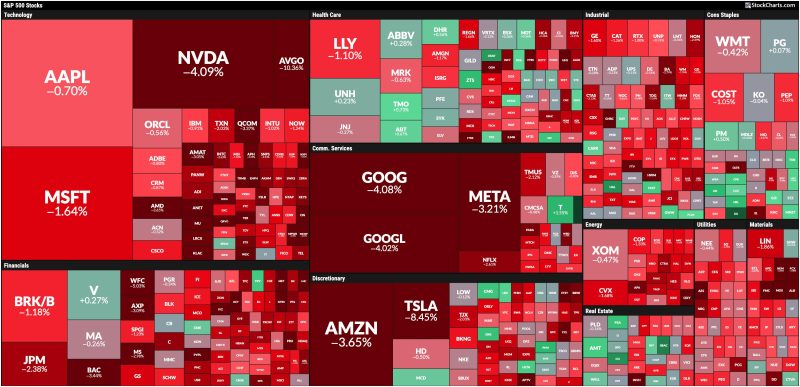

The recent broad-based stock market selloff has left many investors feeling uneasy and uncertain about the future performance of their portfolios. A selloff of this magnitude can be triggered by a variety of factors, including geopolitical events, economic indicators, or global market trends.

One of the key impacts of a broad-based selloff is the potential for widespread price declines across various sectors and asset classes. As investors rush to sell off their holdings, this can create a domino effect that drives prices down even further. This can be particularly challenging for investors who have a high exposure to equities or other risk assets.

In addition to price volatility, a broad-based selloff can also lead to increased market uncertainty and investor anxiety. When markets are experiencing a sell-off, it can be difficult to predict how long the downturn will last or how severe the impact will be. This uncertainty can drive investors to make emotional decisions based on fear rather than rational analysis.

Positioning Your Portfolio for Success During a Selloff

While it may be tempting to panic and sell off your investments during a broad-based selloff, taking a more strategic approach can help position your portfolio for success in the long run. Here are a few key strategies to consider:

1. Diversification: One of the best ways to protect your portfolio during a selloff is through diversification. By spreading your investments across different asset classes, sectors, and regions, you can help reduce the risk of being too heavily exposed to any one area of the market.

2. Stay Informed: During a selloff, it’s important to stay informed about market developments and trends. By staying up to date on market news and economic indicators, you can make more informed decisions about when to buy, sell, or hold onto your investments.

3. Focus on Quality: In times of market uncertainty, it can be beneficial to focus on quality investments with strong fundamentals. Stocks of companies with solid balance sheets, stable earnings growth, and competitive advantages are more likely to weather market downturns and emerge stronger on the other side.

4. Take Advantage of Opportunities: While a selloff can be a challenging time for investors, it can also create opportunities to buy high-quality assets at discounted prices. By keeping a watchful eye on the market and being prepared to capitalize on opportunities as they arise, you can potentially enhance the long-term performance of your portfolio.

Conclusion

In conclusion, a broad-based stock market selloff can be a daunting experience for investors, but by taking a strategic and disciplined approach, you can position your portfolio for success during turbulent times. By diversifying your investments, staying informed, focusing on quality, and seizing opportunities, you can navigate market downturns with confidence and resilience.