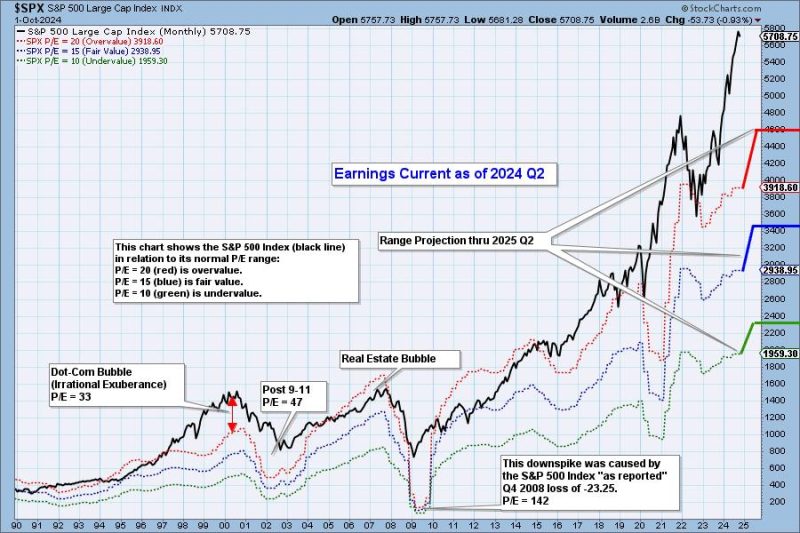

From the article on Godzilla Newz, we see a reflection on the current state of the market in terms of valuation. The 2024 Q2 earnings report reveals that the market is still considered overvalued. This assessment presents an interesting insight into the dynamics at play in the financial landscape.

One key aspect highlighted in the article is the disconnect between market performance and underlying economic fundamentals. Despite concerns over inflation, supply chain disruptions, and geopolitical uncertainties, stock prices have continued to rise. This divergence raises questions about the sustainability of current valuation levels and the potential for a market correction in the future.

The article also points to the role of investor sentiment in driving market valuations. The prevalence of FOMO (Fear of Missing Out) and speculation has fueled a speculative bubble in certain sectors, leading to inflated prices that may not be supported by fundamentals. As a result, investors are advised to exercise caution and conduct thorough research before making investment decisions.

Furthermore, the article discusses the impact of interest rates on market valuations. The prospect of rising interest rates has the potential to dampen market enthusiasm and lead to a reassessment of risk appetite. This could trigger a reevaluation of stock prices and a realignment with economic realities.

In conclusion, the article from Godzilla Newz serves as a timely reminder of the importance of prudent investing and risk management in today’s market environment. As we navigate through uncertain times, it is crucial for investors to maintain a long-term perspective, focus on quality companies, and stay informed about market developments. By staying vigilant and disciplined, investors can position themselves to weather potential market volatility and capitalize on opportunities that may arise in the future.