1. Setting Achievable Goals: Utilize ChartLists to Create a Clear Plan

To maximize the effectiveness of ChartLists, start by setting clear and achievable goals. Having a specific target in mind will guide the creation of your ChartLists and ensure that they serve a purpose. Whether it’s tracking your financial investments, monitoring stock performance, or analyzing market trends, defining your goals will help you select the most relevant data to include in your lists.

2. Organizing Information: Categorize Data for Easy Access and Analysis

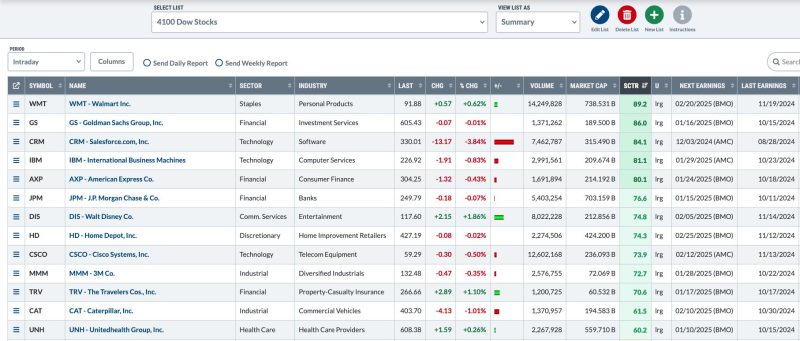

One of the key benefits of ChartLists is the ability to organize vast amounts of information in a structured manner. By categorizing data into specific lists, you can streamline your analysis process and quickly access the information you need. Whether you prefer to group stocks by industry, track performance over time, or compare different asset classes, organizing your ChartLists will make data management more efficient.

3. Utilizing Technical Analysis: Identify Trends and Patterns for Informed Decision-Making

ChartLists offer a powerful tool for conducting technical analysis and identifying trends and patterns in the market. By utilizing various charting options and technical indicators, you can uncover valuable insights that can inform your investment decisions. Whether you’re looking for support and resistance levels, trend reversals, or market momentum, ChartLists provide a visual representation of the data that can help you make informed choices.

4. Conducting Comparative Analysis: Compare Multiple Assets for Performance Evaluation

Comparative analysis is an essential aspect of investment management, and ChartLists make it easy to compare the performance of multiple assets. By creating lists that include different securities, indices, or asset classes, you can conduct side-by-side comparisons to evaluate their relative strengths and weaknesses. Whether you’re assessing the performance of individual stocks, comparing ETFs, or analyzing market indices, ChartLists enable you to identify trends and make data-driven decisions.

5. Monitoring Alerts and Notifications: Stay Informed About Key Market Developments

In today’s fast-paced financial markets, staying informed about key developments is crucial for successful investing. ChartLists offer the functionality to set up alerts and notifications based on specific criteria, such as price movements, technical indicators, or custom conditions. By configuring alerts within your ChartLists, you can stay ahead of market trends, react swiftly to changes, and ensure that you are always informed about important developments that may impact your investment decisions.

In conclusion, ChartLists are a versatile tool that can enhance your investment management process and provide valuable insights into market trends. By setting achievable goals, organizing information effectively, utilizing technical analysis, conducting comparative analysis, and monitoring alerts and notifications, you can leverage the power of ChartLists to make informed investment decisions and achieve your financial objectives.