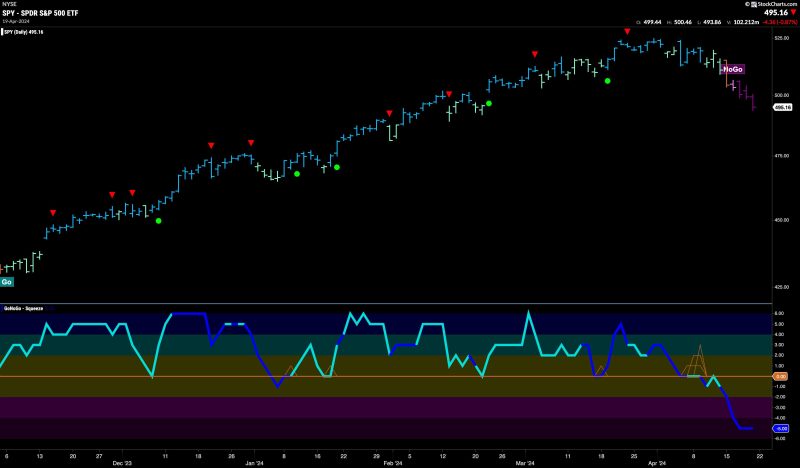

Equities Struggle in Strong Nogo as Materials Try to Curb the Damage

The global equities market is currently grappling with challenges as various sectors navigate the intricate web of economic uncertainties. Among the sectors that are particularly hard-hit, materials are making an effort to mitigate the damage and weather the storm.

One of the key issues facing equities currently is the pervasive presence of a strong nogo sentiment that is casting a shadow over market sentiments. Investors are growing increasingly wary and hesitant in their approach as they assess the risks and rewards associated with different investment avenues.

In this scenario, materials as a sector are facing a unique set of challenges. The materials sector encapsulates a diverse range of industries, including chemicals, mining, construction materials, and more. Each of these sub-industries is grappling with its own set of hurdles as they try to navigate the current economic landscape.

The mining industry, for example, is contending with fluctuating commodity prices and supply chain disruptions that are impacting production and profitability. The construction materials sector, on the other hand, is facing challenges related to infrastructure development and demand volatility.

Despite these hurdles, materials companies are deploying various strategies to curb the damage and sustain their operations. One key approach being adopted is a focus on cost optimization and operational efficiency. By streamlining processes, reducing waste, and enhancing productivity, materials companies are aiming to enhance their competitiveness and weather the market uncertainties.

Additionally, materials companies are also exploring strategic partnerships and collaborations to strengthen their market positioning and expand their reach. By leveraging synergies with other industry players, materials firms aim to tap into new markets, access new technologies, and enhance their product offerings.

Furthermore, sustainability is emerging as a key focus area for materials companies. With growing environmental concerns and regulatory pressures, companies in the materials sector are increasingly investing in sustainable practices and eco-friendly technologies. By prioritizing sustainability, materials companies not only align themselves with changing consumer preferences but also ensure long-term viability and resilience.

In conclusion, while equities are struggling in the face of a strong nogo sentiment, the materials sector is proactively trying to curb the damage and navigate the challenges. By focusing on cost optimization, strategic partnerships, and sustainability, materials companies are positioning themselves for long-term success amidst the prevailing uncertainties in the global market landscape.